Emerging tech's value in a time of healthcare verticalization

Published on | 6 min read

For 2024, I’m going to be switching up some of my posts to focus a bit more on the healthcare industry and current trends. 2023 was a fun time exploring the newest toy in tech (generative AI), but it also came with its share of optimists and pessimists/realists when talking tech in healthcare. I realized it warranted deeper inspection beyond the technology itself, which I will attempt to explore from various perspectives.

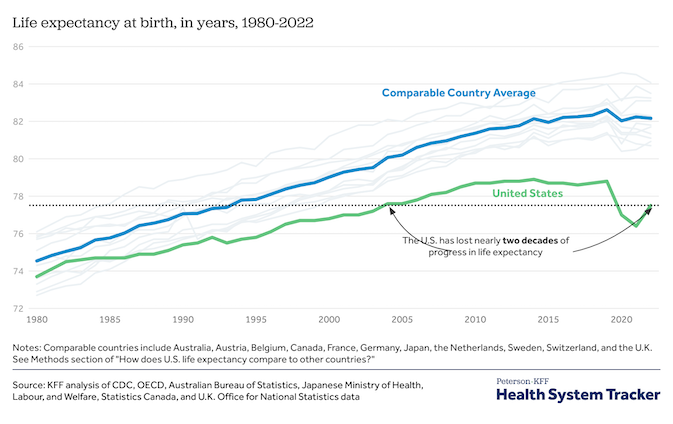

Poor health outcomes still plague the US

According to the Peterson Center-KFF Health System Tracker, in 2022, the US life expectancy at birth still lagged behind its peer countries:

Credit: Rakshit, S., McGough, M., and Amin, K. How does U.S. life expectancy compare to other countries? Peterson-KFF Health System Tracker (January 2024). Used under CC BY 3.0.

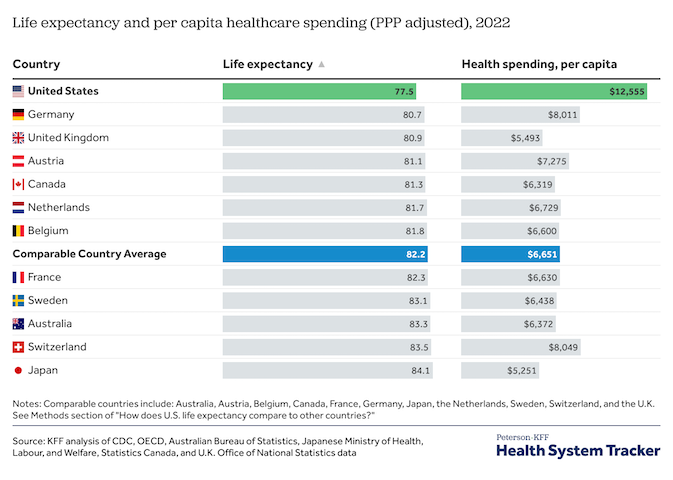

Now let’s look at health expenditures: In 2022, the US spent over $4,000 more per person than the next highest spending country (Germany), and almost twice as much as the average of comparable countries. Note that the US life expectancy still ranks the lowest in the list:

Credit: Rakshit, S., McGough, M., and Amin, K. How does U.S. life expectancy compare to other countries? Peterson-KFF Health System Tracker (January 2024). Used under CC BY 3.0.

When looking at these stats compared to other countries, I couldn’t help but question why - despite the fact that the US is #1 in producing the best software engineers - our health outcomes still fare worse than our neighbors.

If technology isn’t a barrier, what is?

I am not a health economist, but I am reorienting myself to understand the economics and policies that shape our healthcare system that go beyond what technology can fix. This comes from my own experiences as a patient, conversations with health providers, and as a technologist specialized in systems and data.

2023 was a big year for “big health”

Not only was 2023 a big year in tech, it was also a big year for healthcare consolidation. A few months ago, the Economist provided some interesting analysis into the recent cost drivers of the US healthcare system, focusing on 3rd party brokers or “big health” (i.e., insurance, drug distributors, PBMs) vs. pharmaceutical companies and health systems.

Most of this activity involved verticalization by such companies. For example, over the last decade, there has been progressive M&A activity by big names such as CVS Health, Cigna, and UnitedHealth. Perhaps most striking was that these 3rd party players were not just buying up their competitors - CVS buying Aetna (insurer/insurer), Cigna buying Express Scripts (insurer/PBM) - they were also going after healthcare providers.

In February 2023, Optum quietly purchased Crystal Run Healthcare, a 400-person physician group in New York. In April 2023, California-based Kaiser acquired Geisinger, a Pennslyvania-based health system with more than 1,700 physicians. While the financial terms of these deals were not disclosed, Amazon’s completion of its $3.9B acquisition of One Medical in February 2023 gives some insight into the magnitude and importance for these buyers.

This has to be a good thing for all healthcare stakeholders, right?

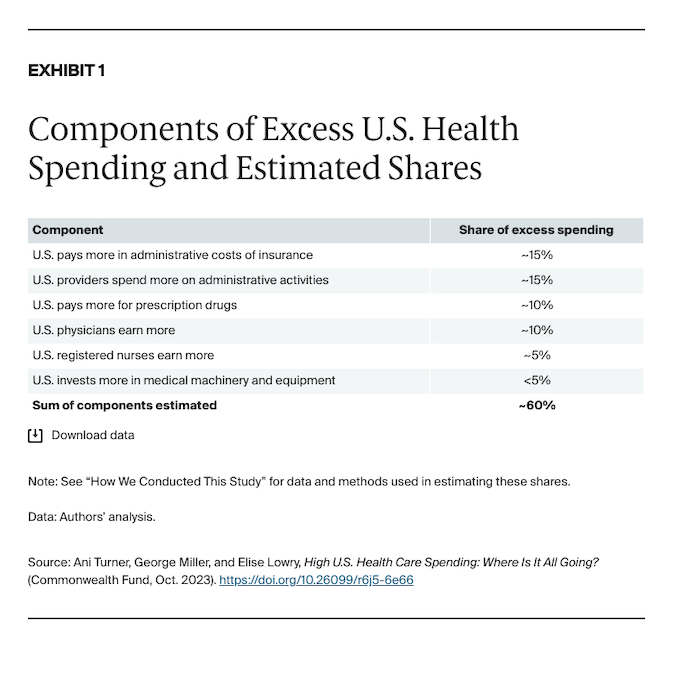

Industry executives think so, with the idea that verticalization will bring all important aspects of medical care - physicians, pharmacy, insurance, and IT systems - under one roof. I certainly like that idea, as the current setup of running around between these entities is beyond frustrating for everyone involved. This sentiment is supported by analysis from the Commonwealth Fund, where administrative costs account for 30% of excess US healthcare spend:

But will this hurt patients in the end? The Economist suggests that there could be unfair competition due to consolidation. Quality of patient care may suffer. All the while, these healthcare intermediaries have been producing excess returns greater than the S&P 500. Much of this has not come to fruition yet, so it will be interesting to see if these strategies pay off. As the Commonwealth Fund notes, regulators and researchers will be watching closely.

The role of emerging technology

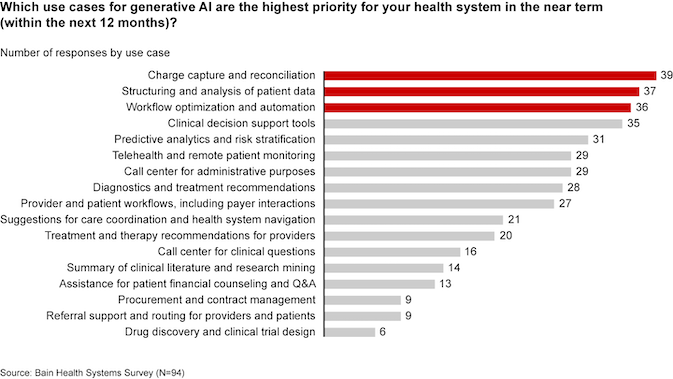

I believe that today’s combination of market forces enabling consolidation and emerging technologies can create lasting efficiencies. One of the earliest benefits I see for generative AI is the ability to summarize data quickly. This can alleviate the administrative burden, especially for pulling together clinical narratives and structured patient data in EHRs, as well as handling workflows such as pre-authorizations. In fact, these are the top generative AI use cases per a Bain & Company report:

However, this is just one very small piece. Dr. Robert Pearl, the former CEO of The Permanente Medical Group, stated that the key to Kaiser Permanente’s decades of success - producing better health outcomes - was due to a combination of innovative insurers and physicians. Although I still have a lot to learn on the insurance side, I can see how this would be a winning formula. Next-gen technologies are by definition innovative, but without key counterparts in risk management and clinical staff, they may fail to produce meaningful results.

Conclusion

This short analysis helped me better understand the external forces driving the ever-increasing costs of healthcare in the United States. Despite the technological prowess of the US, our country still falls behind in terms of health outcomes and spend. I suspect that if we continue to see more consolidations, these tech innovations could play a more important role in health outcomes.

I am also interested in looking at similar tech adoption in other developed countries, and will cover this in a future post.

References

- https://www.healthsystemtracker.org/chart-collection/u-s-life-expectancy-compare-countries

- https://finance.yahoo.com/news/15-countries-produce-best-software-222422955.html

- https://www.economist.com/business/2023/10/08/who-profits-most-from-americas-baffling-health-care-system

- https://rockinst.org/blog/a-mid-year-update-on-2023-healthcare-trends

- https://medcitynews.com/2023/04/kaiser-permanente-acquire-geisinger-hospital-merger

- https://www.forbes.com/sites/brucejapsen/2023/02/22/amazon-achieves-closing-of-one-medical-deal-officially-entering-doctor-clinic-business

- https://www.commonwealthfund.org/publications/issue-briefs/2023/oct/high-us-health-care-spending-where-is-it-all-going

- https://www.bain.com/insights/getting-the-most-out-of-generative-ai-in-healthcare

- https://www.forbes.com/sites/robertpearl/2023/05/31/what-kaisers-acquisition-of-geisinger-means-for-us-all